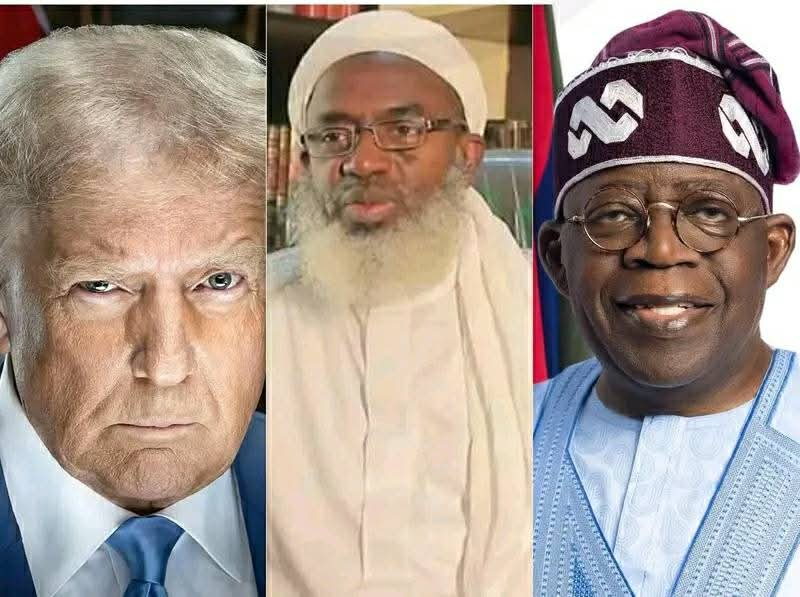

“Shocking: Tinubu’s Tax law Makes Poor Nigerians Richer – NRS Chairman”

By Yahaya Idris, Abuja

The Executive Chairman of the Nigeria Revenue Service (NRS), Zacchaeus Adedeji, has declared that poor and low-income Nigerians are the greatest beneficiaries of the new tax reforms introduced by the administration of President Bola Ahmed Tinubu.

Adedeji, who spoke during a television interview on Sunday on Arise News, said the reforms were carefully structured to shield vulnerable citizens from additional tax burdens and to ease the impact of the rising cost of living across the country.

Senator Karimi says attack on Niger school targets Tinubu administration

He stressed that contrary to widespread fears, the Federal Government is not increasing taxes on ordinary Nigerians.

Instead, he explained that the new tax framework is anchored on extensive exemptions targeted at those on the lower rungs of the economic ladder.

According to the NRS boss, more than 95 per cent of poor Nigerians have been completely exempted from the new tax regime.

He maintained that this exemption is a deliberate policy choice to ensure that the poor do not bear the brunt of ongoing fiscal adjustments.

Adedeji highlighted the removal of Value Added Tax (VAT) on food items as one of the most significant components of the new policy.

He noted that food takes up about 90 per cent of the disposable income of low-income households, making VAT removal a direct relief to millions of families.

“We removed VAT totally from food items,” he said, insisting that this single measure has far-reaching implications for household welfare, especially among the poorest segments of the population.

The NRS Chairman further disclosed that the same approach has been applied to transportation services, another major expenditure line for low-income earners.

By taking off VAT on critical sectors that directly affect daily living, he said, government intends to put more money back into the pockets of struggling Nigerians.

Adedeji argued that when all the exemptions and relief measures are considered together, the overall impact of the reforms is clearly pro-poor.

He described the reform package as one of the most socially sensitive tax interventions in recent years.

He explained that the administration is pursuing a broader strategy of growing revenue without overburdening citizens, especially those already facing economic hardship.

According to him, the focus is on expanding the tax net and improving efficiency, rather than imposing higher rates on the poor. “So if you look at the total and the net benefit, the poor are the most beneficiaries of this tax reform,” he stated, reiterating that the Tinubu administration remains committed to policies that protect the most vulnerable Nigerians while stabilising public finances.