AMCON: The Years of Moratorium Is Over In Nigeria For A Virile Society.

From the announcement of Asset Management Corporation of Nigeria AMCON, through major national dailies and medium of communication on December 5th, 2021, no doubt the notice to publish names of recalcitrant lenders of Non Performing Loans NPL’s will be unveiled by January 5th,2022 for public consumption.

AMCON as the body charged with the main recovery of highly collateralized facilities from the Banks in Nigeria through Eligible Bank Assets EBA’s and Eligible Financial Institutions EFI’s had made several overtures using carrot and stick options in the last one decade, to ensure compliance by Nigeria’s debtors.

Having availed those exposed ample opportunities that involved individuals, institutions, and directors to show commitment and willingness to oblige their indebtedness, there is no doubt that AMCON had provided a soft landing and possible outreach to resolve the over 4trillion exposures by few Nigerians, numbering about 350 that owed 83% of the debt, showed just paltry Nigerians had held the country to total ransom.

With an enabling environment and legislation in place after the amendment of its act and assented by President Muhammadu Buhari, it will be a disservice to Nigerians on the part of the handlers to mellow down on its planned actions to the detriment of the country.

With the new legal position corroborated by section 50B(1) of its amended provision, AMCON had every willingness to ventilate its reactions on unbecoming Nigeria’s debtors, that saw public funds as a free meal and nonrefundable debts, an idea that had eaten deep into the fabrics of many Nigerians.

AMCON had displayed enough remorse, actions, and reactions as well as professional touch in the handling of unperturbed obligors in Nigeria, whose thoughts were hinged on the longer the debts, the lesser actions and reactions from the corporation.

But as a reliable and formidable institution of government whose obligations are matching words and their actions, it’s an unrelenting template that will bail Nigerians out of the current economic uncertainties and quagmire.

Nigeria cannot afford to keep borrowings both from local, and international spheres when its resources of over 4trn were tied down over time with multiple values when plucked into the economy over the years.

Aside from the economy, the critical sectors of social services and unemployment have been at a low ebb with other critical sectors set back at the alter of reckless abandonment to the repayment drive on the part of Nigeria’s obligors, and their collaborators.

Now that the Judiciary, Executive, and Legislature are now on the same page, it is high time for obligors to Banks in Nigeria to demonstrate the willingness to meet their obligations, to avoid any unforeseen circumstances and situations.

The law has no exceptions, no matter how highly placed, the position of the law transcends any other moves by those involved, as AMCON had done enough to resolve the lingering situations.

AMCON decision to publish names of lenders is the best thing that will happen to Nigeria in recent times, as this decision will serve as both precautionary and deterrent measures to perpetual Bank borrowers, capable of returning the country to solvency and the intricacies of underhand and in house round trippings and dealings in the Banking industry.

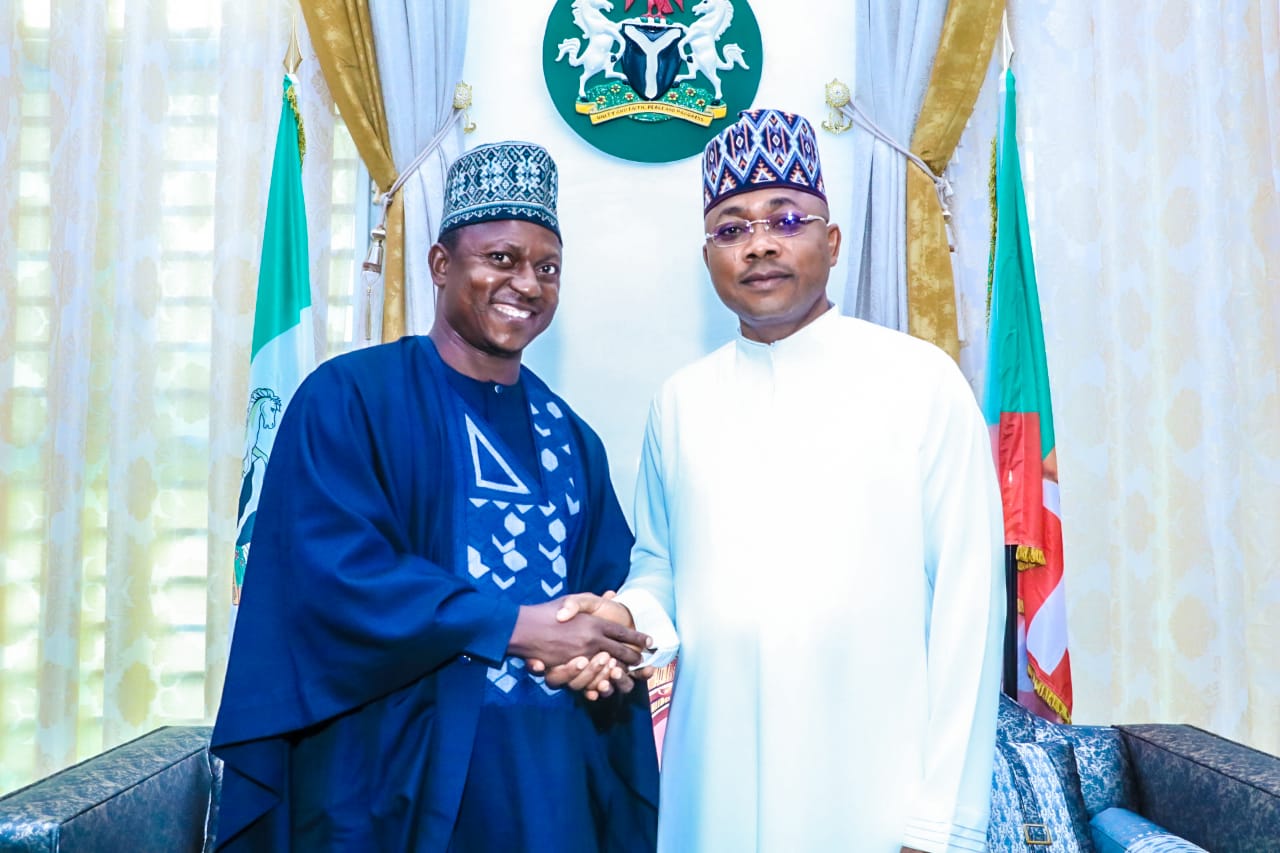

The leadership of AMCON under Ahmed Lawan Kuru took a timely decision, at a time the world is passing through numerous challenges of global dimensions of COVID in different shapes, and other economic crises bedeviling the country, globe.

No doubt, Nigeria obligors in high, middle class, and low would have availed and inundated with the opportunities of coming forward to strike a reliable deal this time around, that will translate to the brisk recovery of their exposures ranging to 4.4trn Banks fund.

No amount of lobbying, cornering and any other unofficial transcripts will see the light of the day, rather than striking a workable deal that will return their exposures to AMCON.

This move will not only better Nigeria’s economy, but all facets of our national life that will return the country to the basis.

Written By Abubakar Yusuf.